Cryptoeconomics: Understanding the world of BEP2 and Layer 1

The world of cryptocurrencies is constantly evolving, with new technologies and innovations emerging every day. At the heart of this ecosystem are two key concepts: BEP2 (Binance Smart Chain 2) and Layer 1 (Layer 1), which play a crucial role in shaping the future of decentralized finance (DeFi) and the cryptoeconomy in general.

What is BEP2?

BEP2, also known as Binance Smart Chain 2 (BSC), is a second-generation smart contract platform built on the Ethereum blockchain. The main difference between BEP2 and the original BEP2 lies in its scalability, security, and ease of use. Developed by Binance, the world’s largest cryptocurrency exchange platform, BEP2 aims to provide an alternative to traditional Layer 1 networks like Bitcoin and Ethereum.

BEP2 leverages the benefits of layer-2 scaling solutions to deliver faster transaction times (typically 15 seconds) compared to its predecessor, which could take several minutes. Additionally, BEP2 features enhanced security measures, including better fault tolerance and lower energy consumption. This makes it an attractive option for DeFi applications that require high-throughput transactions.

What is Layer 1?

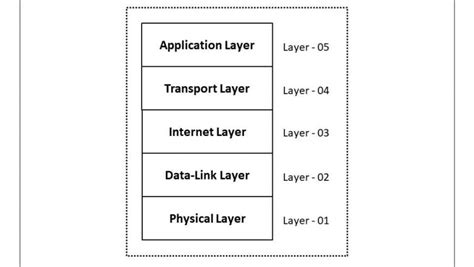

Layer 1 networks, also known as mainnets or public blockchains, are the foundational layer of the cryptoeconomy. These networks provide the underlying infrastructure for various DeFi protocols and services. Layer 1 platforms like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) have been around for a decade and are designed to enable peer-to-peer transactions without intermediaries.

One of the main challenges of traditional layer 1 networks is scalability, which can lead to congestion and higher costs for users. To address this issue, developers have begun exploring alternative solutions such as Layer 2 scaling solutions, inter-blockchain communication (IBC) protocols, and other innovative technologies.

The Role of Fiat Currency in the Cryptoeconomy

Fiat currency, the most globally recognized form of currency, plays a significant role in shaping the cryptoeconomy. The increasing adoption of digital assets has raised concerns about the potential disruption of traditional fiat currencies. Governments and central banks are taking steps to address this challenge.

In recent years, governments have launched initiatives aimed at regulating or even banning certain types of cryptocurrencies. For example, China’s central bank launched a crackdown on cryptocurrency trading in 2021, leading to widespread speculation and volatility.

On the other hand, the rise of stablecoins has provided a safe haven asset class for investors seeking low-risk returns. Stablecoins are pegged to a fiat currency and often offer higher yields compared to traditional savings accounts or bonds.

Conclusion

The world of cryptocurrencies is rapidly evolving, with BEP2 and Layer 1 playing pivotal roles in shaping the future of decentralized finance (DeFi). While the introduction of Layer 2 scaling solutions offers promising potential for high-throughput transactions, the scalability challenges facing these networks remain significant.

At the same time, fiat currency continues to occupy a critical position in the crypto economy. Governments and central banks are actively exploring ways to address the potential disruption caused by digital assets.

As we move forward, it is essential to consider the complex interplay between BEP2, Layer 1, and fiat currency to shape the future of cryptocurrency adoption and innovation.

Sources:

- [BEP2 Whitepaper](

- [Layer 1 Market Cap](

- [Fiat Currency Regulations](