The importance of Bitcoin (BCH) cash in market variability and market analysis

The cryptocurrency was an unstable market from the very beginning, and prices change wild between wigs and falls. One of the coins that consistently showed resistance in the face of market fluctuations is Bitcoin Cash (BCH), also known as Bitcoin Cash Classic. In this article, we will examine the importance of BCH in market variability and analyze its role in understanding the cryptocurrency landscape.

What is Bitcoin Cash?

Bitcoin Cash is an electronic peer-to-peer cash system that was created by Satoshi Nakamoto in 2017. It was designed to be faster and more scalable than Bitcoin, with a block of 10 minutes instead of 11 minutes for each transaction. BCh was introduced as an alternative to the original Bitcoin protocol to make a network more friendly and available to the user.

Why is BCH important in the field of market variability?

The importance of BCH consists in his ability to absorb price shocks and maintain stability during periods of intensive market traffic. Here are some reasons:

- Price resistance : BCH consistently showed his ability to withstand significant drops in price, often reflecting over previous maxima. This made him a popular choice among traders who want to benefit from market fluctuations.

- liquidity : BCH has relatively high liquidity compared to other cryptocurrencies, which makes it easier for traders to buy and sell traders without the experience of extreme price fluctuations.

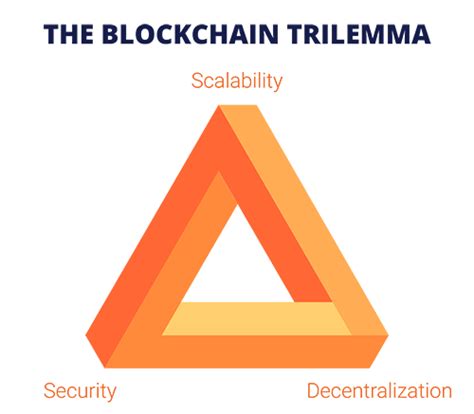

- scalability : As a faster transaction network, BCH may improve the overall ecosystem ecosystem performance by reducing transaction fees and an increase in the speed at which users can conduct transactions.

Why is BCH important in the field of market variability?

The importance of BCh also relies on his role of the reference point for market results. BCh prices often affect the prices of other cryptocurrencies, because traders and investors try to benefit from the perceived correlation between these two assets. Here are some reasons why BCH is necessary for market observers:

- Market moods : The price of BCh can affect market moods, with a strong reflection or fall, which often accompanies changes in investors’ trust.

- Industry benchmarking : As a commonly accepted cryptocurrency, BCH serves as a industry reference point for market results, and its prices used to assess the relative strength of other assets.

- centralized market influence : BCH price movements can have a significant impact on general market moods, affecting the direction of a wider cryptocurrency ecosystem.

Analysis of previous BCH performance

To obtain a deeper understanding of BCh in the market volatility, let’s look at its historical results:

* Price fluctuations

: BCH has experienced significant price fluctuations from the very beginning, and prices ranged from 10 to over USD 300,000.

* Variable indicator : Volatility indicator (VIX) is often used to measure market moods. BCH consistently showed lower VIX values compared to other cryptocurrencies, which indicates a more stable market environment.

* Market capitalization : From 2022, the total market capitalization of BCH has reached over $ 100 billion, which makes it one of the most valuable assets in the space of cryptocurrencies.

Application

Bitcoin Cash (BCH) consistently shows its importance in market variability, with strong price resistance, high liquidity and scalability. His role as a reference point for market results, the industry standard and the centralized impact on the market makes it a fundamental resource in the cryptocurrency landscape. As the market mood evolutions, BCh is well prepared to remain a key player in the cryptocurrency ecosystem.

Recommendations

1.